- #Wyoming county irecorder of deeds full#

- #Wyoming county irecorder of deeds download#

- #Wyoming county irecorder of deeds free#

#Wyoming county irecorder of deeds download#

The Statement of Value must be completed in its entirety and submitted in duplicate with a reason for the exemption and the amount of exemption.Ī Statement of Value must also be submitted for easements and rights-of-ways.Niobrara County’s recorded land documents are available online through Ĭustomers can subscribe and gain access, view, download and/or print images for a subscription fee. If the transfer is between family members, the relationship must be stated on the deed. A Statement of Value is not required if the transfer is wholly exempt from tax based on familial relationship or public utility easement.

#Wyoming county irecorder of deeds full#

When submitting a deed that pertains to property in more than one municipality, the percentage of local transfer tax for each municipality must be stated.Ī Statement of Value is necessary whenever (1) the full consideration is not set forth in the deed, (2) when the deed is without consideration or is by gift, or (3) a tax exemption is claimed. A corrective deed must also include a Statement of Value and a recorded copy of the document being corrected.ĩ.Ě re-recorded document must be acknowledged again, and must also include the reason for re-recording.ġ0. The party submitting the documents is responsible for any re-recording expenses resulting from an improper order of recording.Ĩ.Ěny corrective documents must include a reference to the document being corrected, as well as the reason for correction. If multiple documents constituting one transaction are submitted, the order of recording must be clearly indicated. If claiming an exemption from taxation, the deed must be accompanied by an original and fully completed Affidavit of Value.ħ. In order for a recorded document to provide constructive notice under the Pennsylvania recording laws, it must have a Uniform Parcel Identifier number.ĥ.Ě signed Certificate of Residence, with the grantee's name and mailing address should be attached to the deed.Ħ.Ě deed should state the true consideration of the property or should be accompanied by an original Affidavit of Value. For assistance with this, contact the County Mapping Department. The Uniform Parcel Identifier number that has been assigned to the parcel must be stated on the document.

Please do not staple the document.ģ.Ě complete legal description of the real property must be present, which should include the municipality, state, and county of the property.Ĥ. Use black ink and a font size of at least 9 point.

#Wyoming county irecorder of deeds free#

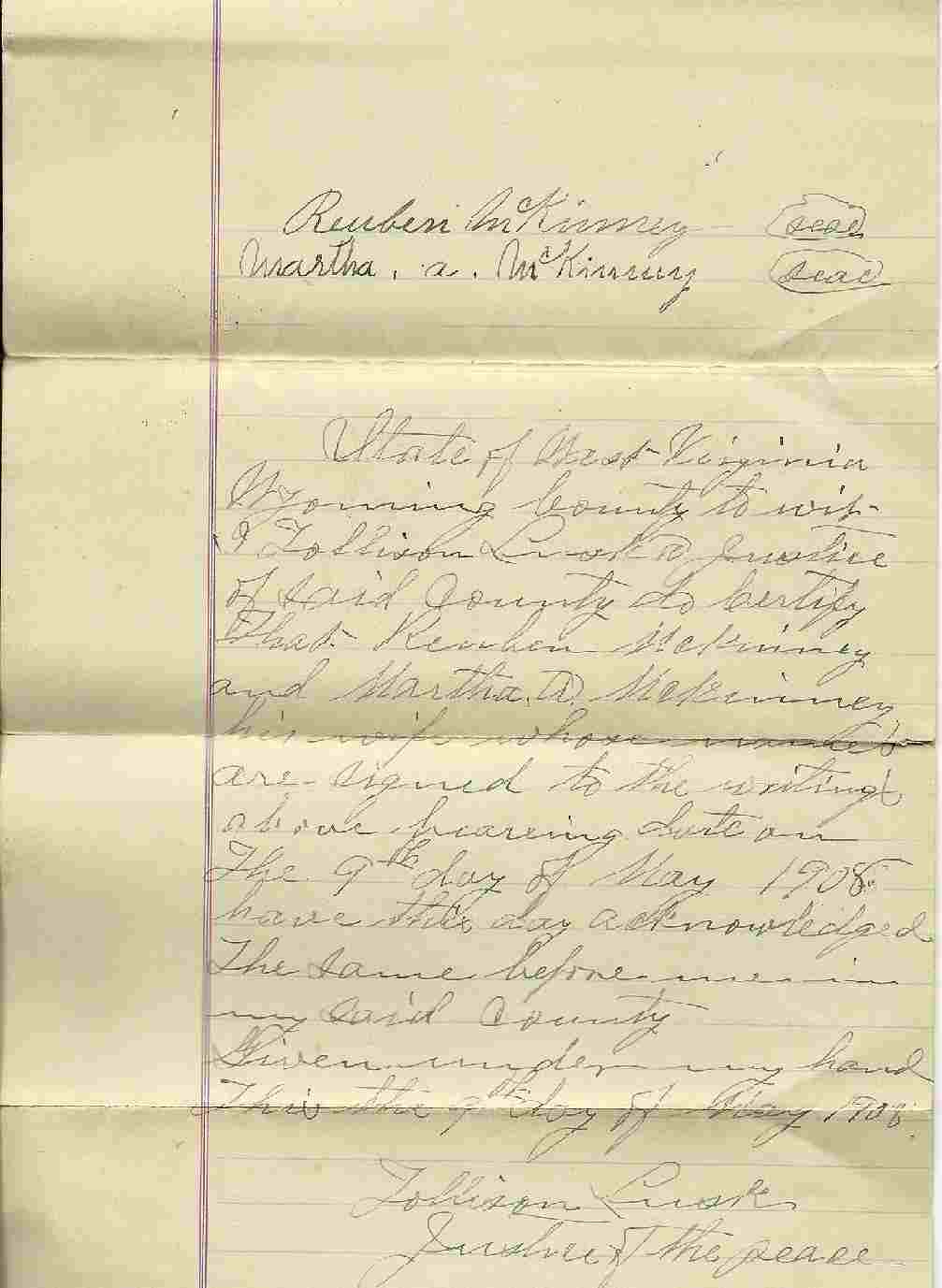

Margins should be a minimum of 1-inch and should be free from all markings. The maximum size page accepted is 8.5 x 11 inches. The acknowledgment date should be on or after the execution date of the document.Ģ. Other necessary elements are a notary signature, notary stamp, and the notary expiration date. The name of the person acknowledging should be given exactly the same as it appears in the document. An acknowledgment must include the county and state. Document Formatting Requirementsġ.Ě deed must be acknowledged before the Recorder of Deeds can consider it. If the overage is more than $5, the document will be returned unrecorded.įor all multiple recordings, there is a 20 document limit per check for non-taxable documents only. Overages of $5 or less are kept by the recorder. The public can come in to our office to do research and make copies of.

Include a self-addressed stamped envelope so that documents can be returned.Īll recording fees must be paid in the exact amount, as refunds are not given. Our office records and maintains a permanent record of documents recorded in our office. Marginal notations beyond the first one are $2.Ĭertified copies are $5.00 for up to 8 pages and $.50 per page after the 8 pages.Ī state tax of 1% and a local tax of the same amount is due upon recording. Each additional page is $2, and each additional name is 50 cents. The base fee for recording a deed or Mortgage is $63.75 Recording requirements must be met and fees must be paid before recording can take place. These records include deeds, easements, and other instruments used in the conveyance of property. The Wyoming County, Pennsylvania recorder of deeds is responsible for recording and maintaining the real property records for the county. Pennsylvania - Wyoming County Recorder Information

You are NOT on the Wyoming County official website, you are on, a private website that is not affiliated with any government agency.

0 kommentar(er)

0 kommentar(er)